The Fiscal Cliff Deal And Your Taxes

Short Answer: Your Taxes Will Go Up

The new deal to avoid the fiscal cliff means the average Alabamian will pay an additional $579 dollars a year in taxes, but some will pay much more. The tax package passed by Congress yesterday prevents one set of tax increases from hitting most Americans, but it won’t stop them all. A temporary Social Security payroll tax reduction will expire, meaning nearly every wage earner will see taxes go up. The wealthy also face higher income taxes.

The median household income in Alabama is just under $43,000. How the tax increases will affect households at different income levels:

Annual income: $20,000 to $30,000

Average tax increase: $297

Annual income: $30,000 to $40,000

Average tax increase: $445

Annual income: $40,000 to $50,000

Average tax increase: $579

Annual income: $50,000 to $75,000

Average tax increase: $822

Annual income: $75,000 to $100,000

Average tax increase: $1,206

Annual income: $100,000 to $200,000

Average tax increase: $1,784

Annual income: $200,000 to $500,000

Average tax increase: $2,711

Annual income: $500,000 to $1 million

Average tax increase: $14,812

Annual income: More than $1 million

Average tax increase: $170,341

Once praised, settlement to help sickened BP oil spill workers leaves most with nearly nothing

Thousands of ordinary people who helped clean up after the 2010 BP oil spill in the Gulf of Mexico say they got sick. A court settlement was supposed to help compensate them, but it hasn’t turned out as expected.

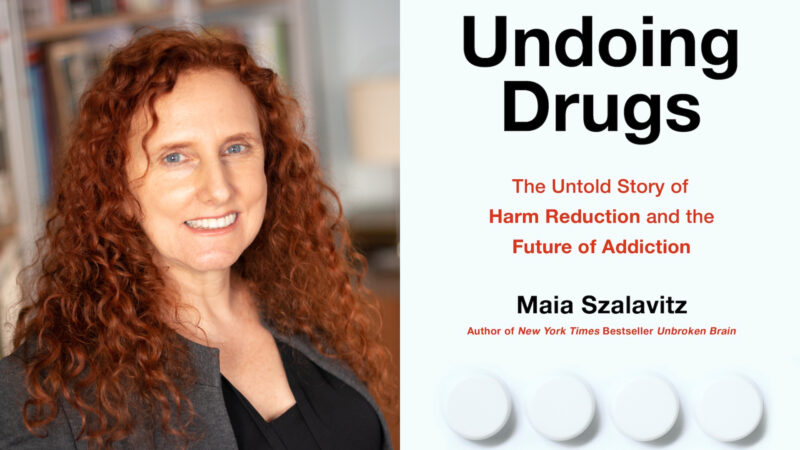

Q&A: How harm reduction can help mitigate the opioid crisis

Maia Szalavitz discusses harm reduction's effectiveness against drug addiction, how punitive policies can hurt people who need pain medication and more.

The Gulf States Newsroom is hiring a Community Engagement Producer

The Gulf States Newsroom is seeking a curious, creative and collaborative professional to work with our regional team to build up engaged journalism efforts.

Gambling bills face uncertain future in the Alabama legislature

This year looked to be different for lottery and gambling legislation, which has fallen short for years in the Alabama legislature. But this week, with only a handful of meeting days left, competing House and Senate proposals were sent to a conference committee to work out differences.

Alabama’s racial, ethnic health disparities are ‘more severe’ than other states, report says

Data from the Commonwealth Fund show that the quality of care people receive and their health outcomes worsened because of the COVID-19 pandemic.

What’s your favorite thing about Alabama?

That's the question we put to those at our recent News and Brews community pop-ups at Hop City and Saturn in Birmingham.