Realty Check

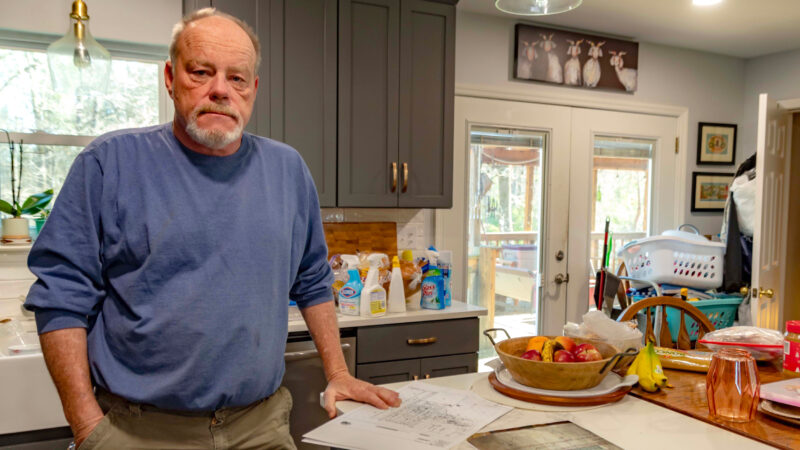

“Trying to downsize a house that’s too big and too expensive and looking for something cheaper and easier to maintain.”

In stark contrast to his current large home, Prescott has been looking at foreclosed properties in Birmingham.

“The prices are really good right now on the foreclosures, unfortunately for sellers, but good for buyers.”

Recent numbers show area home sales are down 26 percent this year. While month-to-month sales have increased slightly, the more profound downward trend has been hard to reverse. In many metro neighborhoods, tough economic times have translated to increased foreclosures and an overall drop in home prices.

Realtor Johnathan Quinn unlocks the door to a foreclosed Ranch-style home located near Ruffner Mountain in South Eastlake.

“It’s a three bedroom, two bath post-modern war home in a neighborhood where the comps are between $100,000 and $120,000. Originally listed at $45,000, down to $21,000.”

As we enter the front door, it’s apparent the house has seen better days. White paint covers markings on old wood paneling, carpet is missing, and the kitchen is down to the bare cabinets. Copper pipes, or anything of value for that matter, have been stripped including the sink.

“That’s something we’re running into in these foreclosures. The air conditioners being stolen, the plumbing being stolen…”

Quinn says he’s seen foreclosures like this one triple in the last year. On the same street, five foreclosures have been listed since May alone.

“Three of which have sold, and there’s two currently listed. And there’s three what I call regular listings, which are regular sellers who have agents that have their properties listed.”

He says it’s definitely not what he terms “the good old days” in the real estate market.

“The market was hot and the prices were high and I mean they were just going left and right within 60 days.”

Now, the foreclosed properties are moving quickly, leaving other homes sitting on the market for six months or more.

But not every community around Birmingham has seen such a drastic decline. David Emory, a realtor who works in Hoover and Vestavia Hills, says the market has slowed from all time highs but hasn’t taken quite the hit.

“Right now, our two offices are doing very well. We’re very blessed in the fact that we did not have some of the spikes that some of the markets had. So we’ve basically kind of leveled off to an area that I would consider normal. I’m seeing a normal market now. Normal days on market. Normal contracts. Normal business sort to say.”

Emory says even though foreclosures are up in his suburban enclave, home values – including those of foreclosures – have remained steady.

“You know I’m still seeing those houses sell pretty reasonably priced. I mean they are a good deal, but they’re no better deal than probably someone down the street could give them.”

The average sale price in Hoover is $309,000 according to the Birmingham Association of Realtors. In contrast, home prices in Eastlake average $32,000. And more homes on the market are making things worse.

“The goals of the industry is to reduce inventory and of course this is adding inventory to the equation.”

That’s Grayson Glaze, the head of the Alabama Center for Real Estate at the University of Alabama.

“Perhaps the areas that are experiencing the most foreclosures are the same areas that had the highest level of the sub-prime loan product at that particular time.”

Sub-prime loans offered a rate below prime for borrowers who might not have qualified for a traditional mortgage, however when the introductory rate ended, many homeowners could not afford the higher monthly payments. Even with the mortgage mess, Glaze says the market may show growth as early as next year with fewer foreclosures and increased home values.

“Projections are that Birmingham will end the year and be in a position to show positive sales growth in the year 2009.”

That’s a prediction that doesn’t wash in the more economically-depressed area of town homeowner Ron Prescott is exploring.

“I’m thinking g maybe it’s going to take a couple years for things to come back up. I don’t think it’s going to be anything that’s going to happen in six months.”

And while real estate agents such as Johnathan Quinn and David Emory say homes in their respective areas might cater to different income groups – they do agree on one thing. It’s a buyers market full of economic challenges.

Alabama’s racial, ethnic health disparities are ‘more severe’ than other states, report says

Data from the Commonwealth Fund show that the quality of care people receive and their health outcomes worsened because of the COVID-19 pandemic.

What’s your favorite thing about Alabama?

That's the question we put to those at our recent News and Brews community pop-ups at Hop City and Saturn in Birmingham.

Q&A: A former New Orleans police chief says it’s time the U.S. changes its marijuana policy

Ronal Serpas is one of 32 law enforcement leaders who signed a letter sent to President Biden in support of moving marijuana to a Schedule III drug.

How food stamps could play a key role in fixing Jackson’s broken water system

JXN Water's affordability plan aims to raise much-needed revenue while offering discounts to customers in need, but it is currently tied up in court.

Alabama mine cited for federal safety violations since home explosion led to grandfather’s death, grandson’s injuries

Following a home explosion that killed one and critically injured another, residents want to know more about the mine under their community. So far, their questions have largely gone unanswered.

Crawfish prices are finally dropping, but farmers and fishers are still struggling

Last year’s devastating drought in Louisiana killed off large crops of crawfish, leading to a tough season for farmers, fishers and seafood lovers.